Lithium producers including Ganfeng and Tianqi expect their net profits in 2023 to be much lower than in 2022, with the common reason being a sharp drop in lithium prices.

Major Chinese lithium producers have previewed dismal 2023 financial results, with lithium prices experiencing an epic drop.

Lithium producers, including Ganfeng Lithium, Tianqi Lithium, and Chengxin Lithium, expect their net profits in 2023 to be much lower than in 2022, with the common reason being the sharp drop in lithium prices.

Ganfeng — the world’s largest lithium producer by market capitalization — expects net profit attributable to shareholders to be between RMB 4.2 billion ($585 million) and RMB 6.2 billion in 2023, a decrease of 69.76 percent to 79.52 percent from RMB 20.5 billion in 2022, according to its earnings preview released on January 30.

After non-recurring gains and losses, Ganfeng expects its net profit in 2023 to be RMB 2.3 billion to RMB 3.4 billion, a year-on-year decrease of 82.96 percent to 88.47 percent.

Ganfeng expects it to have basic earnings per share of RMB 2.09 to RMB 3.08 in 2023. For comparison, the figure was RMB 10.18 in 2022.

Ganfeng blamed the decline on the cyclical effects of the lithium industry, saying demand growth slowed and lithium product prices fell sharply.

Lithium raw material prices fell less than lithium product prices, leading to a decline in the company’s gross margin, it said.

In addition, the company made impairment provisions on some assets, so the company’s performance fell sharply year-on-year, Ganfeng said.

Tianqi expects net profit attributable to shareholders in 2023 to be between RMB 6.62 billion and RMB 8.95 billion, a year-on-year decrease of 62.9 percent to 72.56 percent.

After deducting non-recurring gains and losses, Tianqi expects net profit in 2023 to range from RMB 6.5 billion to RMB 8.82 billion, a year-on-year decrease of 61.75 percent to 71.81 percent.

Tianqi’s basic earnings per share is expected to be RMB 4.04 to RMB 5.46 in 2023, down from RMB 15.52 in 2022.

Tianqi said the company’s lithium product sales price decreased compared with the previous year due to fluctuations in the lithium chemical products market.

In addition, SES Holdings, in which Tianqi holds a stake, went public in New York in 2022, giving it an investment gain of about $1.2 billion, while there was no such non-recurring gain in 2023.

BYD-backed Shenzhen Chengxin Lithium Group expects net profit attributable to shareholders to range from RMB 700 million to RMB 800 million in 2023, down 85.59 percent to 87.39 percent year-on-year.

After non-recurring gains and losses, Chengxin expects its net profit in 2023 to be RMB 130 million to RMB 195 million, a year-on-year decrease of 96.48 percent to 97.65 percent, according to the preview announced yesterday.

Chengxin’s basic earnings per share will be RMB 0.76 to RMB 0.87 in 2023, down from RMB 6.4 in 2022.

Chengxin similarly blamed the decline on a sharp drop in lithium prices, saying it led to a squeeze on the profitability of its products.

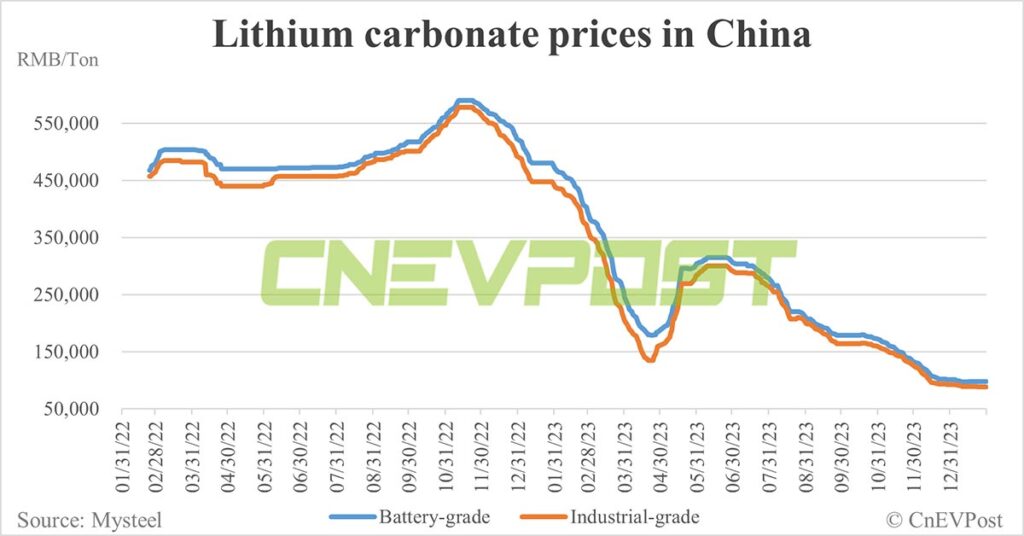

The price of lithium carbonate, a key raw material for batteries, rose to about RMB 600,000 per ton in China at one point in November 2022, about 14 times the June 2020 average price of RMB 41,000 per ton.

After that, however, there was a prolonged decline in lithium carbonate prices, with battery-grade lithium carbonate prices falling about 80 percent throughout 2023, data from Mysteel monitored by CnEVPost show.

($1 = RMB 7.1792)

Battery price war: CATL, BYD pushing battery costs down further